german tax calculator munich

Personal taxation in Munich. As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February 2020 and 20 Euro.

German Income Tax Calculator Expat Tax

935 out of your salary capped at 74400 pa Adding all these elements up you can see that this gets expensive.

. German Income Tax Calculator Expat Tax. Easily calculate various taxes payable in Germany. However how much a company pays also depends on the industry.

Foreign tax paid may be credited against German tax that relates to the foreign income or may be deducted as a business. From a higher income onwards small deductions are made. Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc.

Singles can earn 8130 EUR per year tax free. The German Annual Income Tax Calculator for the 2022. 15 out of your salary capped at 74400 pa Pension.

Also known as Gross Income. Dog tax in Berlin. A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year.

6000 EUR 7000 EUR. Use our income tax calculator to calculate the tax burden resulting from your taxable income. Annual income 25000 40000 80000 125000 200000.

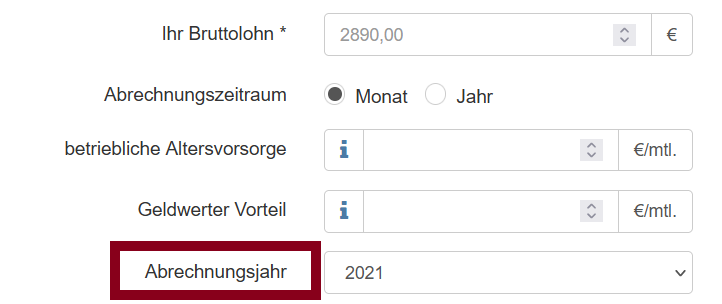

Salary Before Tax your total earnings before any taxes have been deducted. 2021 2020 2019 2018. I am gonna write down some main cities.

2022 2021 and earlier. Above this income there are flat rates. About the German Income Tax Calculator.

Find tech jobs in Germany. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. Airport charges - Munich Airport.

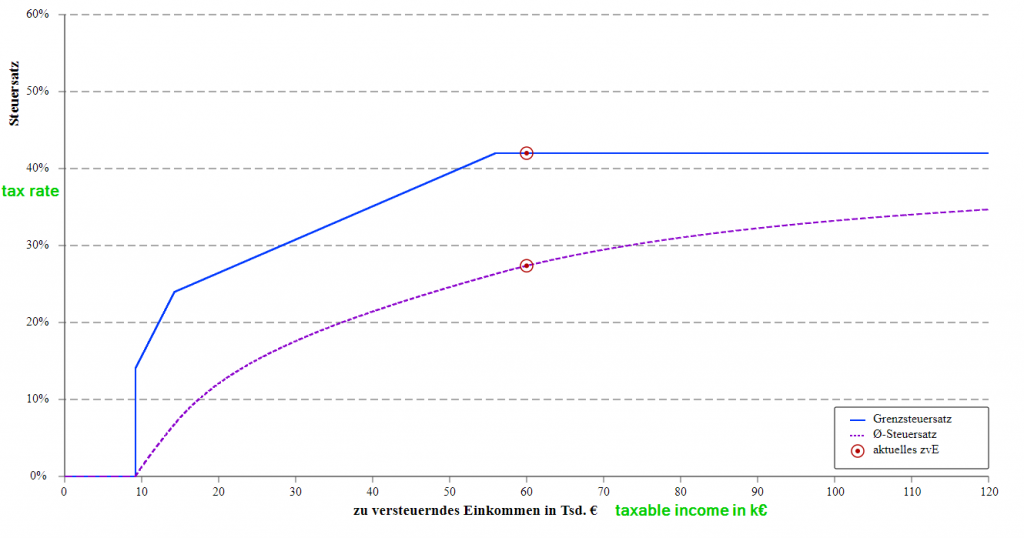

Tax Rates Lohnsteuer A basic personal allowance is deducted from taxable income it is for single persons. To start with this rate increases progressively up to a rate of 42 for a taxable income of 27782500. With a push on the button you will get a detailed estimate of your taxi cost.

Effective personal income tax rate. The calculator is provided for your free use on our website whilst we aim for 100 accuracy we make no guarantees as to the accuracy fo the calculator. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property.

If you receive a salary only as an employee on a German payroll you get. Germany has relatively low refund rate for small purchases at or below 10. In Germany taxes are taken straight out from your salary.

The more advanced the studies the higher the wage. The vehicle mounted meter ensures that the taxi price is neither higher nor lower than mandated. Private Tax Lohnsteuererklärung Self Employed Gewerblich Which year s do you wish to do the tax return.

Germany has one of the lowest minimum spending requirements at 25 EUR. The so-called rich tax Reichensteuer of 45. Online Calculators for German Taxes.

Your company will pay the amount of your tax on your behalf. It is a progressive tax ranging from 14 to 42. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

German Grossnet Calculator Wage Calculator for Germany. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. Youll then get a breakdown of your total tax liability and take-home pay.

If you live in Europe but hold long-term visa to some non-EU country you are eligible for VAT refund in Germany. It starts with 14 when you earn 8130 EUR plus 100 EUR. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag.

1175 out of your salary capped at 50850 pa Unemployment benefits. Income Tax calculations and expense factoring for 202223 with historical pay figures on average earnings in Germany for each market sector and location. ICalculator German Income Tax Salary Calculator is updated for the 202223 tax year.

For your offers and searches for employment EasyExpat provides an other Job section where to post job offers and CV. The rate varies between federal states from 35 to 65 of the propertys value. 978 0000.

775 out of your salary capped at 50850 pa Old age care. Married couples can double that sum. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

This one-off tax applies when a property valued at more than 2500 euros is transferred from one owner to another. More than 7000 EUR. After this sum every euro you earn will be taxed with a higher percentage.

This sum rises in 2014 to 8354 EUR. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. The minimum tax rate is 14.

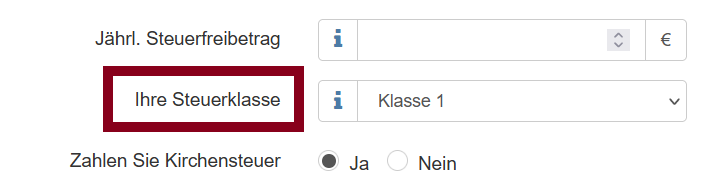

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. Updated on Tuesday 07th November 2017. The German Income Tax Calculator is designed to allow you to calculate your income tax and salary deductions.

Property sales tax Grunderwerbssteuer You will be liable to pay a property sales tax if you are buying a house in Germany. Heres Teleports overview of personal corporate and other taxation topics in Munich Germany. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of.

This document is very important because its used by your employer to calculate your tax. Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence. Some cities charge extra almost 1000 per year if your dog is considered a dangerous breed.

The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. The maximum tax rate in Germany is 42 per cent. It also depends if your dog is from a dangerous breed.

Income more than 58597 euros gets taxed with the highest income tax rate of 42. To the income tax. Please note that this application is only a simplistic tool.

Our taxi fare calculator Munich works by simply entering start and ride destination in the dialog window Drive me. Choose Income Tax Calculator. Salary calculations include gross annual income employment expenses and all insurances and pension factors.

Tax Calculator in Germany.

German Tax System Taxes In Germany

German Income Tax Calculator Expat Tax

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany Income Tax Calculator 2022

German Income Tax Calculator Expat Tax

Faq German Tax System Steuerkanzlei Pfleger

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf

Calculate Your Taxes In Germany Immigrant Spirit

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn

Forecasting German Freelance Net Income Finance Toytown Germany

German Vat Calculator Vatcalculator Eu

I Want To Learn About German Tax Calculator And Also Is There Any Mandatory Tax Deduction Over And Above What Is Shown In The Calculator Quora

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf